Decentralized

Machine Learning

Intelligence

Layer

Powered by:

+11,000 engineers

+1,200 PhDs

A decentralized network connecting top machine learning engineers and AI enthusiasts with institutions and businesses to solve predictive intelligence challenges from quantitative finance to genomics.

Backed by the best

For Organizations

Access 10,000+ ML researchers and 1,200+ PhDs across 100+ countries.

Proven results:

+17% performance improvement vs ADIA Lab Causality Research benchmark

+14% improvement vs Broad Institute of Harvard and MIT computer vision benchmark

4% trading cost savings at major bank (FX OTC)

Models stay encrypted end-to-end so your IP is protected

For Researchers

Work on real problems from top institutions with $100k+ prize pools per challenge

Earn USDC rewards plus $CRNCH tokens

Build your rankings and verifiable track record solving high-stakes challenges for top global organizations, including Harvard and MIT

For Network Participants

Stake $CRNCH on coordinators running challenges

Earn emissions when your chosen operators deliver results

Turning collective Intelligence

into double-digit edge

ADIA Lab Causality Challenge: +17% improvement in performance

Broad Institute of Harvard and MIT Autoimmune Challenge: +14%

improvement in cancerous cell detection

FX OTC: up to 4% savings on trading cost

Trusted by

Infrastructure

DECENTRALIZED INTELLIGENCE IN ACTION ON CRUNCH

Business Problem

The client shares a Machine Learning problem to solve

A Coordinator sets up a Crunch Challenge, using the protocol’s tools to define rules and rewards while ensuring confidentiality and IP protection.

Data scientists worldwide submit models to compete for rewards.

The coordinator rewards Crunchers based on performance

Problem Solved

Roadmap

A clear view of what’s next—our key milestones, upcoming features, and future plans to support our growing ML community

Products

our product line and see how our innovative technology is driving success and empowering creators in the real world

Crunch Hub

Launch and showcase ML competitions effortlessly, connecting with our global network of 10,000+ machine learning engineers.

Coordinator Nodes

Harness Crunch network’s intelligence through competitions under your rules while retaining full data control.

Mid+One Engine

Ultra-low-latency predictions and computations built for financial and real-time applications.

Crunch Engine

A secure, open-source ML orchestration layer that runs in your cloud with full ML workflow control and seamless Crunch ecosystem integration.

Proof in action

Explore our case studies and see how our innovative technology is driving success and empowering creators in the real world

Real-Time FX Pricing

Win more client flow with tighter, faster pricing. Reduce slippage and optimize inventory holding times in volatile markets.

- <60μs Latency: Ultra-low latency pricing to prevent stale quotes and slippage.

- Tighten Spreads: Adapts to volatility instantly, allowing you to win more client flow.

- Inventory Management: sharper predictive signals reduce toxic inventory hold times.

Computer Vision in Healthcare

How the Broad Institute engaged 1,000 researchers to build models that infer expensive molecular data from cheap tissue images, advancing the early diagnosis of colorectal cancer.

- Accuracy of our customer benchmark x2

- Gene Panel experiments based on the community models

- Hopefully leading to improved diagnosis, prognosis, and treatment of cancer

Market Regime Detection

How ADIA Lab partnered with Crunch to crowdsource novel algorithms that detect "Structural Breaks"—invisible changes in market rules—achieving double-digit accuracy improvements.

- Regime Detection: Identifying invisible "Change Points" before P&L impact.

- Adaptive AI: Models that "unlearn" irrelevant history to adapt instantly.

- Double-Digit Gains: Outperforming standard baselines by double-digit percentages.

Causal AI in Finance

How ADIA Lab partnered with Crunch to advance the field of Causal AI, identifying robust drivers in high-dimensional data that standard machine learning misses.

- Built the world’s best Causal Discovery Algorithm to date

- Collaborated with 2021 Economics Nobel Laureate

- Outperformed by 17% ADIA’s internal team

Prof. Marcos

Lopez de Prado

Crowdsourcing has a very important role to play in investing. Firms turn investing problems into forecasting problems, then outsource to global researchers.

Peter

Cotton

Institutional finance hasn’t yet had disruption, but likely will; specifically with respect to the competition for research talent in the years to come.

Prof. Guido

Imbens

I'm very excited to see what the participants are going to come up with, because if they come up with useful things, that's going to be very impactful.

crunch news

Discover what the media is saying about us. Explore the latest articles and news covering our innovation and impact.

Autoimmune Disease Crunch 2 Spotlight #10 - Jingzhe Ma

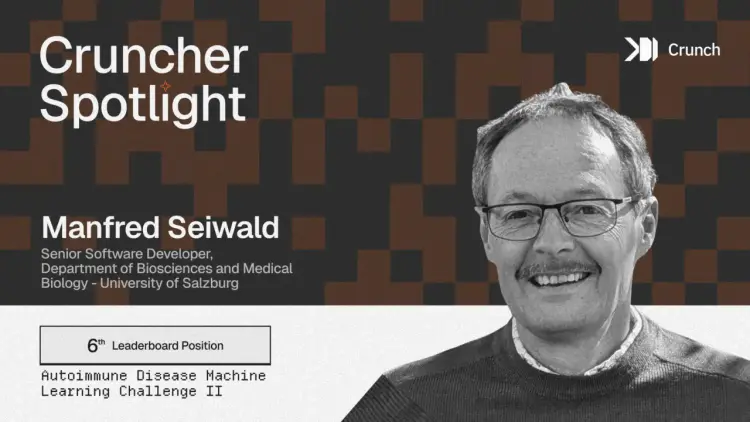

Autoimmune Disease Crunch 2 Spotlight #6 - Manfred Seiwald

Introducing Saroj Mahapatra, Head of Enterprise Data at Crunch

Autoimmune Disease Crunch 2 Spotlight #4 - Team Amaris

Autoimmune Disease ML Challenge – Results Timeline Update

Crunch Welcomes Grégoire Colcombet as Chief of Staff to Drive Strategic Growth

Autoimmune Disease Crunch 2 Spotlight #3 - Team Cellmates

CrunchDAO Partners with Phala to Secure Decentralized AI Models Using TEE Technology

CrunchDAO and io.net Partner to Power Decentralized Compute for Next-Generation AI

.png)